Department of Justice has filed a range of possible changes for Google as a response to a federal judge who ruled that Google is a “monopolist.”

Earlier this week, the DOJ signaled that it is considering breaking up Google as a possible antitrust remedy. The DOJ is looking at “behavioral and structural remedies” to stop Google from using products like Chrome, Play, and Android to give an advantage to its search engine. In a filing late Tuesday night, the government outlined its plan to curb the tech giant.

The proposals suggest ending exclusive agreements Google has with companies like Apple (which the DOJ also bit at back in the day) and Samsung, and banning certain types of data tracking.

This 32-page filing follows U.S. District Court Judge Amit P. Mehta’s August ruling that found Google to be operating as a “monopolist,” paying billions of dollars to remain the default search engine on web browsers and smartphones, including Apple’s.

The decision by the U.S. District Court for the District of Columbia has the potential to reshape how millions of users access information online and could disrupt decades of Google’s market dominance. Google has spent tens of billions of dollars on exclusive contracts to secure its place as the default search provider for smartphones and web browsers worldwide. These agreements have enabled Google to suppress potential competitors like Microsoft’s Bing and DuckDuckGo.

The filing suggests using “a full range of tools” to restore competition and prevent Google from leveraging its Chrome browser and Android operating system to reinforce its search engine dominance, which currently accounts for about 90% of all internet searches globally. However, breaking up a company, especially one as large as Google, is no small feat.

Kent Walker, Google’s president of global affairs, stated that the company plans to appeal the ruling, emphasizing the court’s recognition of the high quality of Google’s search products. Google’s Vice President of Regulatory Affairs, Lee-Anne Mulholland, called the DOJ’s recommendations extreme.

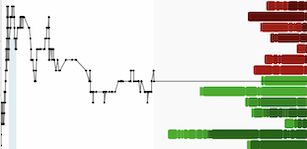

The potential breakup or behavioral restrictions could heighten regulatory risks for Alphabet. Investors might become more cautious, leading to stock volatility or even a sell-off.

Google’s exclusive deals are crucial to its search dominance. If these agreements are limited or terminated, Google could lose significant search traffic, affecting its primary advertising revenue. This would likely hurt Alphabet’s long-term profits and stock value.

If Google is forced to end its exclusive partnership with Apple, this could also impact Apple’s revenue from Google. Google is said to pay billions of dollars to Apple for this arrangement, and losing that income could have a small, though noticeable, effect on Apple’s services revenue, potentially leading to fluctuations in Apple stock.

So far, this development might have caused short-term volatility in Alphabet’s stock, as antitrust news typically prompts immediate market reactions. Apple may also experience minor uncertainty, but the direct impact on its stock could be minimal unless the situation escalates.